GST Filing made easy. Avoid penalties and complexities.

Struggling With GST Compliance? Not Anymore!

Our certified professionals make understanding GST easy through personalized assistance and support.

why choose us?

- We are India’s leading online platform for GST filing

- We have a team of qualified and experienced professionals

- Offer a 100% money-back guarantee within 24 hours.

- Safety and security of your data and payment.

- Save time and money by simplifying the GST filing process.

- We are ready to help you with your GST filing.

Personalized GST assistance

* Start Your Risk-Free Filing Now, 100% Money Back Garantee!

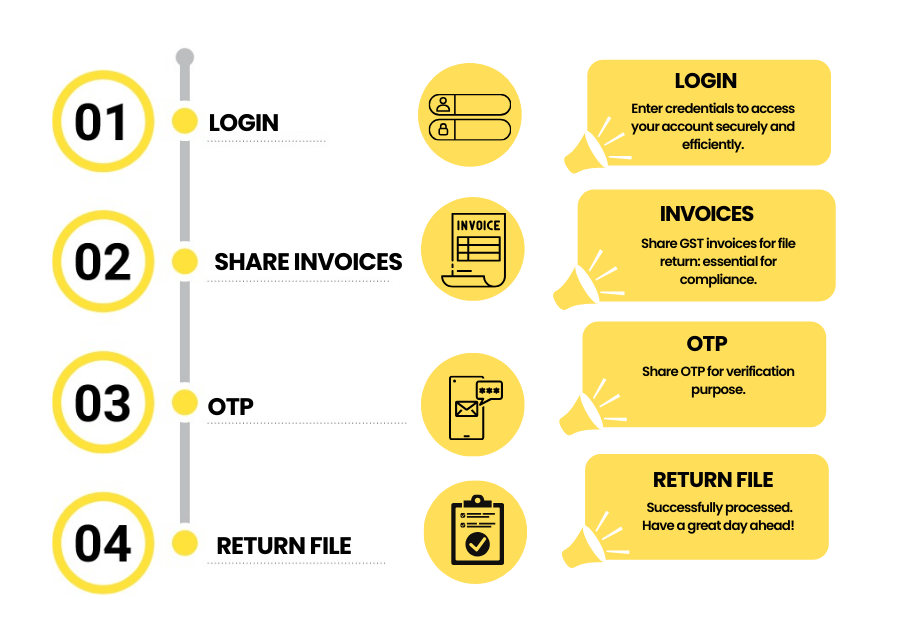

How We Work

SUBMIT YOUR INFO

Fill out the form to send us relevant information.

CONNECT WITH YOU

Our team of experts will connect with you to understand needs.

FORM FILLING

With strong due diligence there are no chances of errors in Refund Filing.

DEPARTMENTAL SUBMISSION

We will submit all required documentation to the departments. .

CONTINUOUS FOLLOW UP

We follow up with the GST Authorities.

ISSUE GST NO.

With strong due diligence there are no chances of errors in Refund Filing.

Features

Claim of ITC

Increase in GDP

Ease of business

Elimination of Taxes

Increase in Revenue

Saving More Money

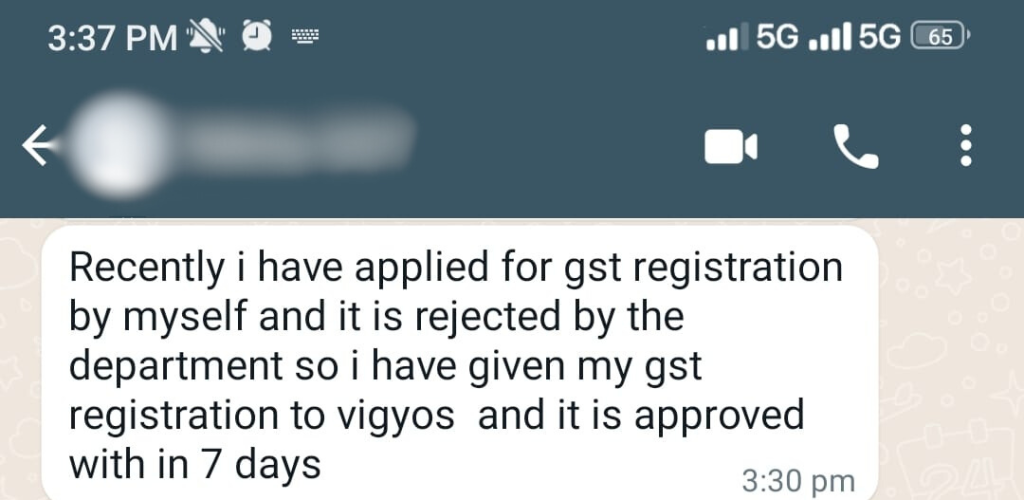

They Trust Us

Back By 100% Money Back Guarantee

Money Back Guarantee

We are confident that you will be satisfied with our GST filing service. We have a team of qualified and experienced professionals who will handle your GST compliance with utmost care and accuracy. However, if for any reason you are not happy with our service, you can request a full refund within 7 days of receiving your GST return. No questions asked.

To claim your refund, simply contact us at support@vigyos.com or call us at+91 7000360484 and provide your order details. We will process your refund within 24 hours of receiving your request.

We value your trust and feedback, and we strive to provide you with the best GST filing service in India. Thank you for choosing Vigyos.

START GST FILING NOW

Reduce business risk with our expert help!

Frequently Asked Questions

Who needs to file GST returns?

Any business or individual registered under GST needs to file GST returns. This includes businesses with a turnover above the prescribed threshold.

Can I make changes to a filed GST return?

Yes, corrections can be made to GST returns through the filing of amendment returns. However, there are limitations on the type of corrections that can be made.

What is the due date for filing GST returns?

It's important to check the GST portal or consult with a tax professional for specific deadlines.

What happens if I miss the GST filing deadline?

Late filing of GST returns may attract penalties and interest. It's crucial to adhere to the due dates to avoid these additional charges.

What is Input Tax Credit (ITC)?

Input Tax Credit is a mechanism where a taxpayer can claim a credit on the GST paid on purchases, which can be set off against the GST liability on sales.

Is there any GST exemption for small businesses?

Some small businesses may qualify for the Composition Scheme, which allows them to pay a fixed percentage of their turnover as GST and be exempt from detailed return filing.

THIS SITE IS NOT A PART OF THE FACEBOOK WEBSITE OR FACEBOOK INC. ADDITIONALLY, THIS SITE IS NOT ENDORSED BY FACEBOOK IN ANY WAY. FACEBOOK IS A TRADEMARK OF FACEBOOK, INC. WE DO NOT OFFER ANY RESELLER RIGHTS – WE ARE NOT RESPONSIBLE FOR IF YOU BUY FROM ANYOTHER WEBSITE/SELLER COPYRIGHT 2023

VIGYOS IS A REGISTERED TRADEMARK OF YOURSUPERIDEA TECHNOLOGIES PVT LTD.